Unlike other trade finance certifications, the CTFP has a broad, comprehensive curriculum that will help you develop a wide range of expertise. Go beyond documentary credits to give yourself the freedom and flexibility to move between different roles and departments and respond to a wide range of client needs.

Certified Trade Finance Professional (CTFP)

The gold-standard in trade finance certifications

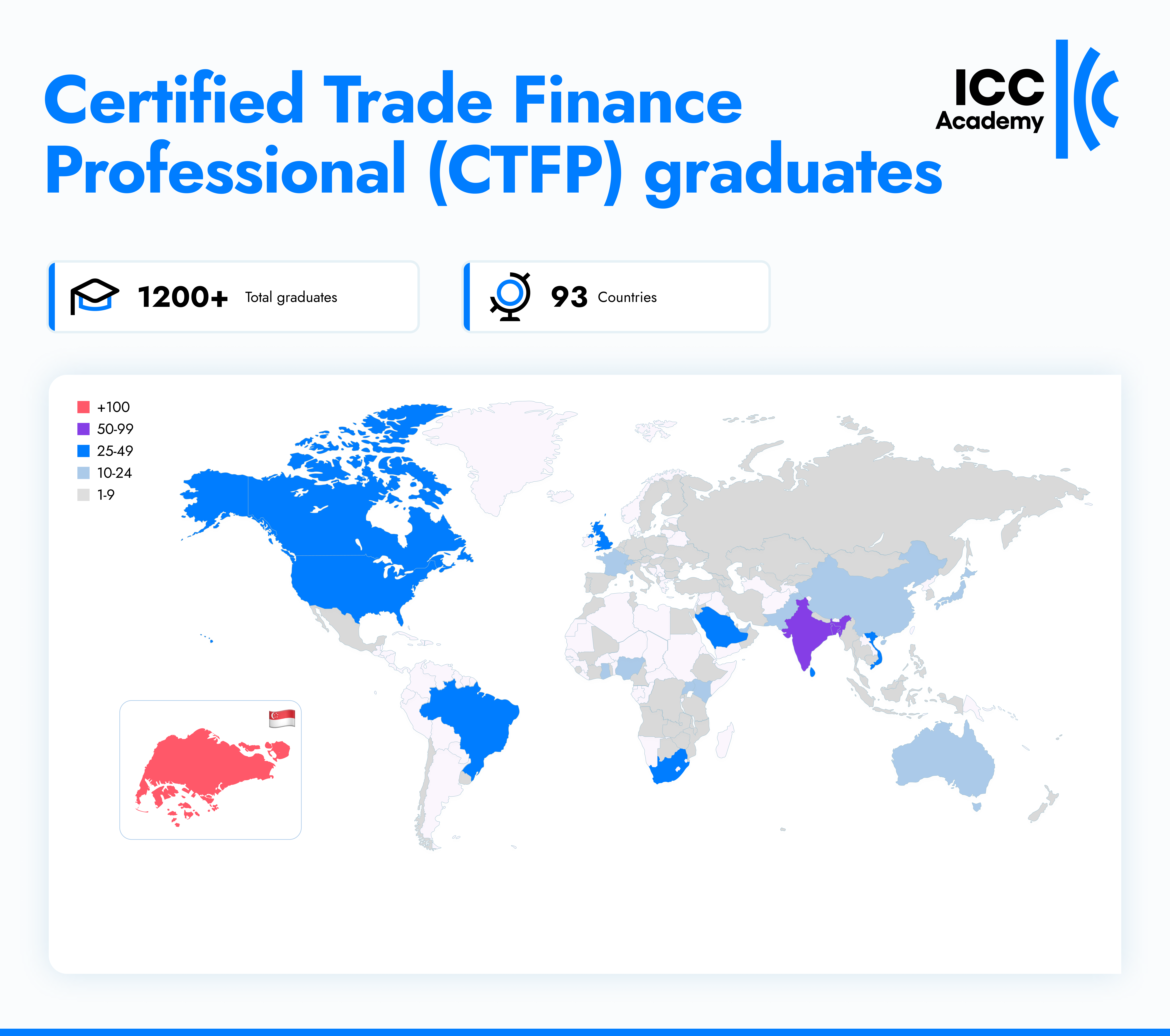

Upgrade your credibility, expertise and authority in the trade finance industry with an advanced credential from ICC, the organisation that produces many of the rules and guidelines for the industry. The CTFP is an internationally accredited qualification that will help clients and colleagues see you on a different level and is trusted by alumni in more than 90 countries.

The curriculum of the CTFP has been authored by 11 experts from the ICC Banking Commission and covers a wide spectrum of trade finance solutions over more than 50 hours of online learning. You will develop the well-rounded skillset needed to overcome challenging scenarios, move into new roles, enhance relationships with clients and gain more trust from your colleagues.

How the CTFP works

Register for CTFP

Get 6 months’ access to 5 core courses

Choose 4 elective courses (also 6 months’ of access)

Complete all 9 courses

Pass final exam

Download and share your ICC certificate of achievement

Certificate curriculum

The CTFP curriculum has been developed by 11 experts from the ICC Banking Commission and is internationally accredited by Bankers Association for Finance and Trade (BAFT), the London Institute of Banking & Finance (LIBF) and the Global Trade Professionals Alliance (GTPA). It consists of 5 core courses and a range of elective courses of which you must choose 4. Each course will take approximately 5-6 hours to complete.

CTFP core courses

You must complete all 5 core courses to take the final CTFP exam.

Learn the cash flow and working capital cycle of commercial companies and develop a core understanding of the meaning and functions of working capital. Find out more about the Advanced Working Capital for Trade course.

This letter of credit training course provides a detailed review of documentary credits, from structuring and issuance to document verification to financing and settlement. Find out more about the Advanced Documentary Credits course.

Learn more about the issuance of a bank guarantee, the use of counter guarantees and more complex transactions. Find out more about the Advanced Guarantees course.

Learn the key role export credits and official export credit agencies play in international sales and its financing, particularly in developing nations. Find out more about the Export Finance course.

Gain an in-depth understanding of how various SCF products meet the financing and risk mitigation needs of different events and stages in the supply chain. Find out more about the Advanced Supply Chain Finance course.

CTFP Elective courses

Once you register for the CTFP you will be able to choose the 4 elective courses you wish to complete as part of your certification.

Learn the fundamentals of factoring, including its types and applications, its operational aspects and how to effectively sell this supply chain finance product. Find out more about the Factoring course.

Get to grips with the digital trade ecosystem including the advent of fintechs, the legal, regulatory and commercialisation challenges involved. Find out more about the Digital Trade Finance & Fintechs course.

An in-depth look at how standby letters of credit work, the purposes for which they can be used and the rules and regulations governing them. Find out more about the Advanced Standby Letters of Credit course.

Learn how to align the organisation of your sales team and staffing model to your bank’s business strategy, target customer markets and sales coverage process. Find out more about the Managing Trade Sales course.

This course will provide mid-level bank officers an overview of the key responsibilities of trade operations management and the skills required for long term success in the position. Find out more about the Managing Trade Operations course.

Learn a bank manager’s role in handling trade finance products and the working model product managers should use to enhance and/or develop trade products. Find out more about the Managing Trade Products course.

Learn about the three types of commodities, their features, and the risks involved in financing them as well as commodities trading from a banker’s perspective. Find out more about the Advanced Commodity Finance course.

Examination FAQ

To pass the CTFP and earn your ICC certificate you will need to complete a final 1-hour, online exam.

The final exam can be taken at any time after you have completed the prerequisites – 5 core courses and 4 elective courses. It lasts for 60 minutes and is live proctored via the internet. This means there is someone monitoring your environment via webcam to ensure there is no outside interference and maintain the integrity of the certification. The exam consists of multiple-choice questions.

Your purchase of the CTFP includes 1 attempt at the final exam. The passing mark is 70%. If you score lower than that you will need to purchase a retake for US$100 while you are still within your 6-month access period.

The CTFP is valid for three years from date you pass the exam.

To re-certify you must earn 24 credits before the three-year expiration date.

Credits can be earned through online and offline learning as well as attending relevant events

Latest CTFP alumni

See all alumniFeedback on the CTFP

"I see the CTFP as a perfect way for any trade finance person to (a) be part of a global community and (b) have a certification that highlights your expertise and automatically puts you at a certain level that is respected in the industry."

"I enrolled in the CTFP because this certification is authored by leading trade finance experts from the ICC’s Banking Commission, making it one of the most credible programmes available in the market. Each course is structured to ensure the essentials of global trade finance have been sufficiently covered."

"From a client and correspondent banking perspective, the CTFP credential has strengthened trust and credibility. Customers and partners recognize the certification as a mark of professionalism and global alignment, which is particularly important in a region where trade finance is evolving rapidly to meet international standards."

Who is the CTFP for

The Certified Trade Finance Professional (CTFP) is an advanced programme that targets more senior trade finance and treasury managers and specialists who want a wider range of expertise. We recommend that candidates have +5 years of trade finance experience to enrol.

- Senior corporate banking relationship managers

- Specialists within transaction banking functions

- Senior corporate treasury officers

- Legal and compliance officers within banks

Note: If you have already completed ICC Academy’s Global Trade Certificate (GTC) or The LIBF’s CDCS, CSDG or CITF programmes you can access a special core CTFP programme at a discount and fast track your qualification.

CTFP for teams

More than 500 organisations in over 90 countries have enrolled their teams on our CTFP programme, including major international banks, regional development banks, national banks and large manufacturers. Contact us now to discuss your needs and get a custom quote.

Get started now

Feedback from CTFP alumni

Passing the CTFP was a big factor in helping me secure a new job. It’s focus on the full range of trade finance techniques was very important and has given me a much more well-rounded understanding of the options we can offer our clients. The CTFP should act as a benchmark for advanced trade finance professionals.

"When you talk to people, and people see your credentials when you go out for conversations, the CTFP from the ICC certainly helps. They recognise that you know your stuff and understand trade finance. The ICC brings with it its own brand which is very easily recognised."

The CTFP course has boosted my career prospects. Apart from earning a promotion late last year, I now possess the knowledge and expertise required to function effectively in all the key aspects of the trade finance business (operations, product development and sales).

FAQs

Answers to your most commonly asked questions.

The CTFP is valid for three years before it must be recertified. The objective of recertification is to ensure that CTFP holders continue to maintain the high standards of trade finance skills and understanding that have been accredited to them.

We have recently updated our re-certification requirements to make them more flexible and less costly. You can see full details here.

Your purchase of the CTFP allows one attempt at the exam. If required, a retake can be purchased for USD $100 if you are still within your 6-month access period. Please contact our Help Desk at helpdesk@iccacademy.com.sg

All candidates need to be able to read and write in English. For the Certified Trade Finance Professional (CTFP), we recommend that you have +5 years of trade finance experience, or are already certified via the ICC Academy’s Global Trade Certificate (GTC) or The London Institute of Banking and Finance’s (LIBF) CDCS, CSDG or CITF programmes.

Full CTFP enrolment: Your purchase includes 6 months to access all 9 CTFP courses. You can access the lessons as many times as you like within the 6-month access period. Once you have completed all 9 courses, you will get access to the final exam.

Stack CTFP courses: If you opt to ‘stack up’ CTFP courses as you go then you will get 6 months access to each course from the date you purchase it. This means your access to each course will end on different dates. Please note that this may mean you do not have access to all courses when revising to take the CTFP exam, depending on how quickly you complete the 9 required courses.

If you already hold the CDCS or CSDG qualifications from the London Institute of Banking and Finance, you access a core pack of CTFP courses at a discounted rate. Full details here.

Due to the immediate availability of our course content upon registration, ICC Academy has a strict no-refund policy for our courses and certifications. For more details, please refer to our Terms and Conditions.

Each individual course will take between approximately 5-6 hours to complete depending on your level of experience. To qualify to take the exam you must complete all five core courses and four elective courses of your choice.

To take the exam and earn the CTFP qualification, you will need to complete 9 courses – the 5 core courses and 4 elective courses of your choosing.

For those who purchase the full CTFP enrolment, you will be able to select your elective courses once you have logged in to your account.

FULL CTFP ENROLMENT

- 6-months access to the entire certificate programme – more than 50 hours of online learning over 9 courses, 35 lessons and a final online exam.

- Interactive learning – over 200 assessment questions, 5 pre-assessment games and transaction flow diagrams to help you grasp key concepts easily and review the course material

- 16 case studies – we’ll show you how to apply what you learn to real-world scenarios

- Lesson highlight summaries at the end of every lesson to recap what you have learned

- A timed one-hour online exam – if you pass (70%) you will receive an ICC Academy, industry-recognised certificate

STACK CTFP COURSES

- 6-months access to each course you purchase from the date of purchase. Over 9 courses this adds up to more than 50 hours of online learning over 35 lessons

- Interactive learning – over 200 assessment questions, 5 pre-assessment games and transaction flow diagrams to help you grasp key concepts easily and review the course material

- 16 case studies – we’ll show you how to apply what you learn to real-world scenarios

- Lesson highlight summaries at the end of every lesson to recap what you have learned

- Once you have completed the 9 required courses you can purchase a timed one-hour online exam for USD $100. If you pass (70%) you will receive an ICC Academy, industry-recognised certificate.

- Please note that if you opt to stack CTFP courses, access to each course will end at different times so you may not have access to all courses when revising to take the exam, (depending on how quickly you complete the 9 required courses).

Yes, all our courses and the final exam are taken online. This means they are accessible at any time, from anywhere in the world. Learn when and where you want. You can find more details about how our exams work here.

The Certified Trade Finance Professional is an advanced programme that targets new managers, product specialists, as well as senior transactional bankers. It is also recommended as the next step in the learning pathways for CDCS or CSDG qualification holders. Add to that, CDCS and CSDG holders earn valuable PDUs toward re-certification.

The CTFP is a more advanced programme that targets new managers, product specialists as well as senior transactional bankers covering subjects ranging from working capital to supply chain finance. We recommend you have a minimum of five years experience or an existing trade finance qualification to take the CTFP.

The Global Trade Certificate (GTC) is an introductory-level online certification providing a comprehensive understanding of trade finance products. It’s an ideal programme for professionals wanting to build an understanding of the nuts and bolts of global trade.