Unlike other trade finance certifications, the GTC has a broad, comprehensive curriculum that will help you develop a foundational to intermediate understanding of a wide range of trade finance solutions and concepts, including documentary credits, guarantees, supply chain finance, SBLCs and trade finance sales. You will be equipped to respond to a broad range of client needs.

Global Trade Certificate (GTC)

Build a comprehensive understanding of global trade finance

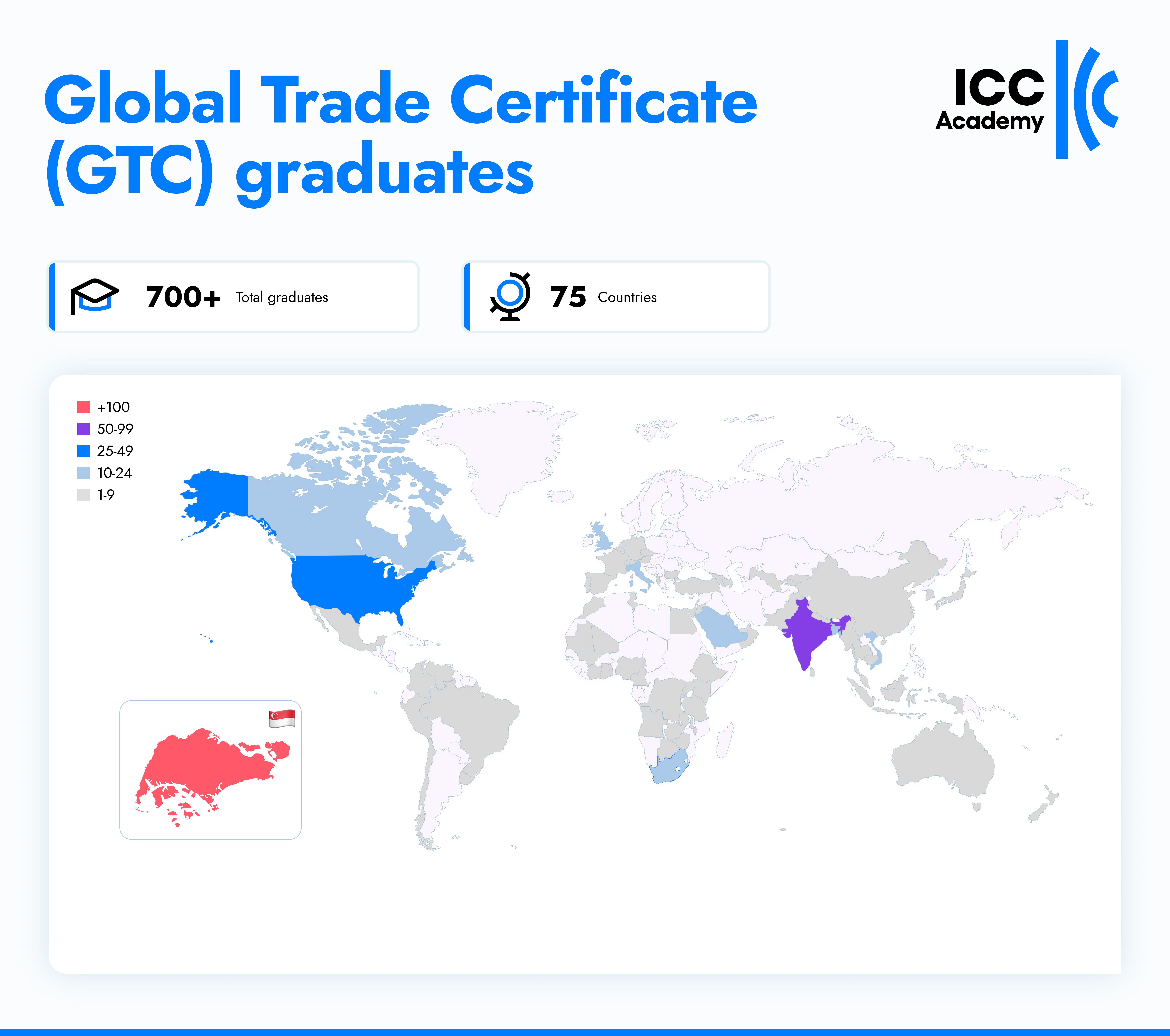

The Global Trade Certificate (GTC) is an introductory-level professional certification that will give you a concrete, foundational understanding of a wide-range of trade finance products. It is internationally accredited by BAFT, LIBF and the Global Trade Professionals Alliance (GTPA), and is trusted by alumni in more than 80 countries.

The curriculum of the GTC has been authored by 12 experts from the ICC Banking Commission and covers a wide spectrum of trade finance solutions, including documentary credits, guarantees, receivables finance and supply chain finance over more than 30 hours of online, interactive learning.

How the GTC works

Register for GTC

Get 6 months access to 6 core courses

Choose 3 elective courses (also 6 months access)

Complete all 9 courses

Pass final online exam

Download and share your ICC certificate of achievement

Certificate curriculum

The GTC curriculum has been developed by 12 experts from the ICC Banking Commission and is internationally accredited by Bankers Association for Finance and Trade (BAFT), the London Institute of Banking & Finance (LIBF) and the Global Trade Professionals Alliance (GTPA). It consists of 6 core courses and a range of elective courses of which you must choose 3. Each course will take approximately 3-4 hours to complete.

GTC core courses

You must complete all 6 core courses to take the final GTC exam.

Develop a foundational understanding of global trade and how companies settle their cross border commercial activities. Learn more about this GTC course here.

Learn the importance of documentary credits, also known as letters of credit, in enabling trade, and their versatility in addressing a range of client needs. Learn more about this GTC course here.

Get a practical overview of documentary collections including the key rules and processes involved. Learn more about this GTC course here.

Build a foundational understanding of demand guarantees and their importance in facilitating global trade. Learn more about this GTC course here.

Get an overview of the core concepts involved in receivables finance, including the major risks and opportunities. Learn more about this GTC course here.

Learn how to engage effectively with manufacturer and exporter clients and to spot opportunities to propose distributor finance solutions. Learn more about this GTC course here.

GTC elective courses

Once you register for the GTC you will be able to choose the 3 elective courses you wish to complete as part of your certification.

Learn the mechanisms, dynamics and key issues in cross-border trade, as well as commercial considerations in international business. Learn more about this GTC course here.

Get a high-level overview of the compliance obligations of financial institutions engaged in trade finance, including the “Know Your Customer” requirements. Learn more about this GTC course here.

Get a practical overview of the high-growth area of supply chain finance (SCF), which covers the majority of global trade flows. Learn more about this GTC course here.

Get an understanding of how to contribute to trade solutions that incorporate risk distribution techniques and to engage internally on its benefits. Learn more about this GTC course here.

Get a core understanding of regulatory capital – including Basel III – as well as standard industry tactics and factors involved in capital calculation, such as capital adequacy. Learn more about this GTC course here.

Learn the practices and processes necessary to be a successful trade finance salesperson, including the key steps to identify, select and prioritise customers. Learn more about this GTC course here.

Learn how to risk proof yourself against operational losses and reputational risk caused by trade finance fraud and explore various fraud prevention techniques. Learn more about this GTC course here.

Examination FAQ

To pass the GTC and earn your ICC certificate you will need to complete a final 1-hour, online exam.

The final exam can be taken at any time after you have completed the prerequisites – 5 core courses and 4 elective courses. It lasts for 60 minutes and is live proctored via the internet. This means there is someone monitoring your environment via webcam to ensure there is no outside interference and maintain the integrity of the certification. The exam consists of multiple-choice questions.

Your purchase of the GTC includes 1 attempt at the final exam. The passing mark is 70%. If you score lower than that you will need to purchase a retake for US$100 while you are still within your 6-month access period.

The GTC is valid for three years from date you pass the exam.

To re-certify you must earn 20 credits before the three-year expiration date. Credits can be earned through online and offline learning as well as attending relevant events.

Latest GTC alumni

See all alumniFeedback from GTC alumni

The GTC gave me peace of mind and more confidence when talking to clients. I needed to know how a facility worked – e.g. what documentation was required, what structure we had in place. The GTC really helped me to explain the process and upgrade my understanding. I can now have a full conversation about finance product offerings where previously I wouldn’t have been able to.

The GTC has added value to my resume by demonstrating that I have a specialisation in international trade finance and that I have learned from an industry validated syllabus. It has provided me with solid expertise on trade finance products.

The GTC enabled me to crystallize my knowledge and experience in trade finance with a formal certification accredited by ICC. This has helped my employer understand the focus of my career and help me with my pathway to advancement.

Who is the GTC for

The GTC is an introductory to intermediate programme designed for banking and treasury professionals new to trade finance, generalists from relationship management and agri-commodities teams, legal and compliance officers, risk management officers, specialists within transaction banking functions and other key support staff.

- New trade finance officers or managers

- Generalists from relationship management

- Legal, compliance and risk management officers

- Specialists within transaction banking functions

Global Trade Certificate (GTC) for teams

More than 250 organisations in over 70 countries have enrolled their teams in ICC’s GTC progamme, including major international banks, regional development banks, national or state banks, large manufacturers and multinational energy companies. Contact us now to discuss your needs and get a custom quote.

Get started now

FAQs

Answers to your most commonly asked questions.

The GTC is valid for three years before it must be re-certified. The objective of re-certification is to ensure that GTC holders continue to maintain the high standards of trade finance skills and understanding that have been accredited to them.

We have recently updated our re-certification requirements to make them more flexible and less costly. You can see full details here.

Your purchase of the GTC allows one attempt at the exam. If required, a retake can be purchased for USD $100 if you are still within your 6-month access period. Please contact our Help Desk at helpdesk@iccacademy.com.sg

All candidates need to be able to read and write in English.

FULL GTC ENROLMENT: Your purchase includes 6 months’ to access all 9 GTC courses. You can access the lessons as many times as you like within the 6-month access period. Once you have completed all 9 courses, you will get access to the final exam.

STACK GTC COURSES: If you opt to ‘stack up’ GTC courses as you go then you will get 6 months’ access to each course from the date you purchase it. This means your access to each course will end on different dates. Please note that this may mean you do not have access to all courses when revising to take the GTC exam, depending on how quickly you complete the 9 required courses.

If you already hold the CDCS or CSDG qualifications from the London Institute of Banking and Finance, then you may be better suited to our CTFP qualification. As a CDCS or CSDG holder you access a core pack of CTFP courses at a discounted rate. Full details here.

Due to the immediate availability of our course content upon registration, ICC Academy has a strict no-refund policy for our courses and certifications. For more details, please refer to our Terms and Conditions.

Each individual course will take between approximately 3-4 hours to complete depending on your level of experience. To qualify to take the exam you must complete all six core courses and three elective courses of your choice.

To take the exam and earn the GTC qualification, you will need to complete 9 courses – the 6 core courses and 3 elective courses of your choosing.

For those who purchase the full GTC enrolment, you will be able to select your elective courses once you have logged in to your account.

FULL GTC ENROLMENT

- 6-month access to the entire certificate programme – more than 30 hours of online learning over 9 courses, over 30 lessons and a final online exam.

- Interactive learning – 100 questions, 6 pre-assessment games, 4 video lectures and transaction flow diagrams to help you grasp key concepts easily and review the course material

- Case studies – we’ll show you how to apply what you learn to real-world scenarios

- Lesson highlight summaries at the end of every lesson to recap what you have learned

- A timed one-hour online exam – if you pass (70%) you will receive an ICC Academy, industry-recognised certificate

STACK GTC COURSES

- 6-month access to each course you purchase from the date of purchase. Over 9 courses this adds up to more than 30 hours of online learning over 30 lessons

- Interactive learning – 100 questions, 6 pre-assessment games, 4 video lectures and transaction flow diagrams to help you grasp key concepts easily and review the course material

- Case studies – we’ll show you how to apply what you learn to real-world scenarios

- Lesson highlight summaries at the end of every lesson to recap what you have learned

- Once you have completed the 9 required courses you can purchase a timed one-hour online exam for USD $100. If you pass (70%) you will receive an ICC Academy, industry-recognised certificate.

- Please note that if you opt to ‘stack GTC courses, access to each course will end at different times so you may not have access to all courses when revising to take the GTC exam, (depending on how quickly you complete the 9 required courses).

The GTC is an introductory-level programme aimed at transactional and relationship managers—as well as executives from management, credit, legal and compliance functions.

The CTFP is a more advanced programme that targets new managers, product specialists as well as senior transactional bankers covering subjects ranging from working capital to supply chain finance. We recommend you have a minimum of five years experience or an existing trade finance qualification to take the CTFP.

The Global Trade Certificate (GTC) is an introductory-level online certification providing a comprehensive understanding of trade finance products. It’s an ideal programme for professionals wanting to build an understanding of the nuts and bolts of global trade.