In this article, guest contributor Sharad Sinha, Executive Director for Transaction Banking at Standard Chartered and member of the ICC Banking Commission, discusses three key trade finance products – letters of credit (also known as documentary credits), and bank guarantees and documentary collections.

The views and opinions expressed in this article are those of the author for education purposes and do not necessarily reflect the official policy or position of ICC Academy, ICC, or Standard Chartered.

According to the 2024 Global Trade Outlook and Statistics report by the World Trade Organisation (WTO), world merchandise trade volume is projected to grow 2.6% in 2024 and 3.3% in 2025. The economies involved in global supply chains help spread technology, know-how and investments.

To help corporates be part of the global supply chain and infrastructure development needed to facilitate growth, banks and other financial institutions use a variety of products to help in the exchange of goods and services.

The types of trade products offered address issues around a typical international cross-border sale and purchase of goods, including:

- Addressing foreign exchange and country risk issues

- Buyer and seller not knowing each other;

- Overcoming local regulations;

- Ensuring shipment and transportation issues

- Ensuring payment and financing options;

- Addressing foreign exchange and country risk issues

Banks provide financing options and payment assurance based on how payment will be settled amongst buyer and seller.

Broadly, trade finance products may be defined as open account and documentary trade. The primary difference being the bank acting as an intermediary to handle transactional documents between the buyer and seller.

Documentary trade products:

- Letter of credit (a.k.a documentary credit)

- Bank guarantees

- Documentary collections

Open account trade products:

- Supply chain finance

- Factoring

- Forfaiting

In this guide, we’ll focus on the three documentary trade products.

Letters of credit

What are letters of credit?

Letters of credit (LC) are instruments, typically issued by banks on behalf of the buyer (applicant), to pay the seller (beneficiary) provided that the terms and conditions of the LC are met. It is a commercial instrument used to secure payments and facilitate the financing of international business transactions. It usually satisfies the seller’s desire for payment and buyer’s desire for credit.

The most significant feature of the letter of credit is that all parties in the commercial credit transaction deal with documents rather than goods.

How do letters of credit work?

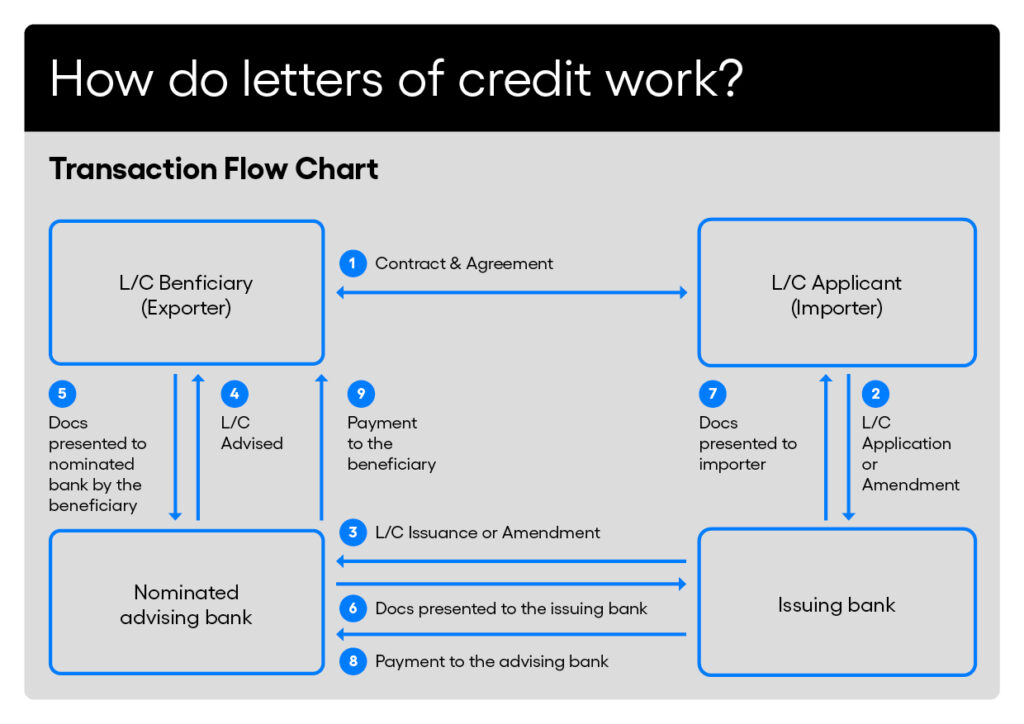

The buyer and seller finalise a sales contract; agreeing on the type of goods, quantity, quality, amount, and how and where the goods will be delivered. Based on the terms and conditions of the contract, the buyer requests the issuing bank to open a letter of credit in favour of the seller (beneficiary) by submitting the standard application form.

The LC stipulates the required documents that enable the buyer to verify that the correct goods, in required quantity (as evidenced by the invoice and packing list) and of requisite quality (inspection certificate), are dispatched from the specified location to the destination using the agreed mode of transportation (as indicated by the transport document). If the sales contract requires insurance, an insurance certificate must also be included in the LC.

The issuing bank opens the letter of credit and typically advises it through a nominated advising bank. The seller then prepares the goods and dispatches it to the buyer. Afterward, the seller prepares all the required documents and presents them to the nominated bank. Nominated bank may choose to examine the documents or simply forward them to the issuing bank.

Upon receiving the documents, the issuing bank examines them, and if they comply with the conditions of the LC, the bank pays or agrees to pay the seller on the due date. The documents are then handed over to the buyer, enabling them to take control of the goods.

What are the benefits to using letters of credit?

The most important feature of an LC is its autonomous nature.

A letter of credit is a separate transaction from the sales contract and represents an independent obligation of the issuing bank to pay. Each party involved focuses solely on the documents, and once these are presented in compliance with the terms and conditions of the LC, the issuing bank is obligated to pay.

Advantages to the buyer/importer

- Buyer will receive the necessary documents for importing the goods, ensuring that they can take possession of the goods at the appropriate time.

- The importer is assured that the exporter will be paid only if all terms and conditions of the letter of credit have been met.

- The importer can negotiate more favourable trade terms with the exporter when offering payment via letter of credit.

Disadvantages to the buyer/importer

- A letter of credit does not protect the importer against the exporter shipping inferior quality goods /or a lesser quantity of goods or potential fraud.

- This risk can be mitigated by requesting additional documents in the letter of credit, such as an inspection certificate from an independent agency.

Disadvantages to the exporter/seller

- Documents must be prepared and presented in strict compliance with the requirements stipulated in the letter of credit. Therefore, it is crucial to assess the ability to produce necessary documents and if needed, seek amendments to LC.

- There is a risk that the issuing bank may fail to pay due to foreign exchange restrictions or insolvency. However, this risk can be mitigated by seeking confirmation from a local bank.

What are the different types of letters of credit, and what are their functions?

| Type of Letter of Credit | Definition |

|---|---|

| Confirmed Letter of Credit | The issuing bank requests another bank – typically in the exporter’s country or a third country – to pay to the beneficiary on their behalf upon presentation of documents. When this arrangement is agreed upon, the credit is known as confirmed credit. |

| Transferable Letter of Credit | Used when the first beneficiary does not supply the goods and therefore needs to transfer part, or all, of its rights and obligations in the LC to the actual supplier. |

| Revolving Letter of Credit | Such LCs provide for the renewal or reinstatement of amount, within the validity of the LC, without requiring amendments for an agreed period. These are used for regular and on-going shipments of the same goods over a period. |

| Back-to-back Letter of Credit | Typically, the ultimate buyer opens an LC, called the master LC, in favour of a trader. Subsequently, a back-to-back (or slave) LC is issued in favour of the actual supplier at the request of the trader, secured by the master LC. |

| Red Clause Letter of Credit | A credit where the issuing bank authorises the nominated bank to pay an advance to the beneficiary as a pre-shipment credit requirement. |

| Green Clause Letter of Credit | A pre-shipment advance is made against beneficiary’s presentation of a document of title to the goods, evidencing storage in a warehouse in the exporter’s country. The relevant document is usually in the form of a warehouse receipt or other similar documents. |

This list highlights several key types of letters of credit, but it is not exhaustive. For a deeper understanding of these and other specialised instruments, including their unique applications and nuances, you can refer to our comprehensive guide: Types of documentary credit | A guide

Use case: Exporter and importer using a letter of credit to ensure payment and delivery

Background for issuance of an LC

ABC Company is a Chinese-based firm that sources wood according to specific requirements and sells it to furniture manufacturers, both domestically and internationally. ABC imports wood from two suppliers:

- Supplier AU is in Australia

- Supplier BR is in Brazil

How an LC caters to ABC Company’s needs according to their working capital cycle

- Promptness of shipments and assurance against short shipment.

- Ensure that the goods supplied are of specified quality (qualified assurance) and receive goods before making payment.

- Fast turnaround time for LC issuance and willingness to share the details of issuance with their suppliers.

- Comprehensive information to make timely payments to their suppliers, and to advise them when paid.

- Financing to meet payment obligation to suppliers.

How an LC caters to the suppliers’ needs for their working capital cycle

- Mitigate risk of non-payment: Once the woods are shipped, both AU & BR can be confident of receiving payment as long as they submit the required in compliance with the terms of the LC.

- Extend usance terms without compromising cash flows: Both exporters (AU & BR) can negotiate the inclusion of usance terms in the LC and seek payment against their receivables.

- Both suppliers can free up their credit lines, enabling them to make more financing available to their businesses.

- Mitigate country risk and issuing bank risk by seeking confirmation within the LC.

Bank guarantees

What is a bank guarantee?

An irrevocable and independent undertaking of the issuer (typically a bank) to pay the beneficiary upon receiving a complying documentary demand, thus providing the beneficiary with security to mitigate the risk of a counterparty breaching its obligation.

Like letters of credit, the principle of autonomy applies here too, meaning it is independent of the underlying contract.

The primary difference is that a bank guarantee is invoked in cases of non-performance or non-payment whereas a letter of credit serves as a payment mechanism.

How do bank guarantees work?

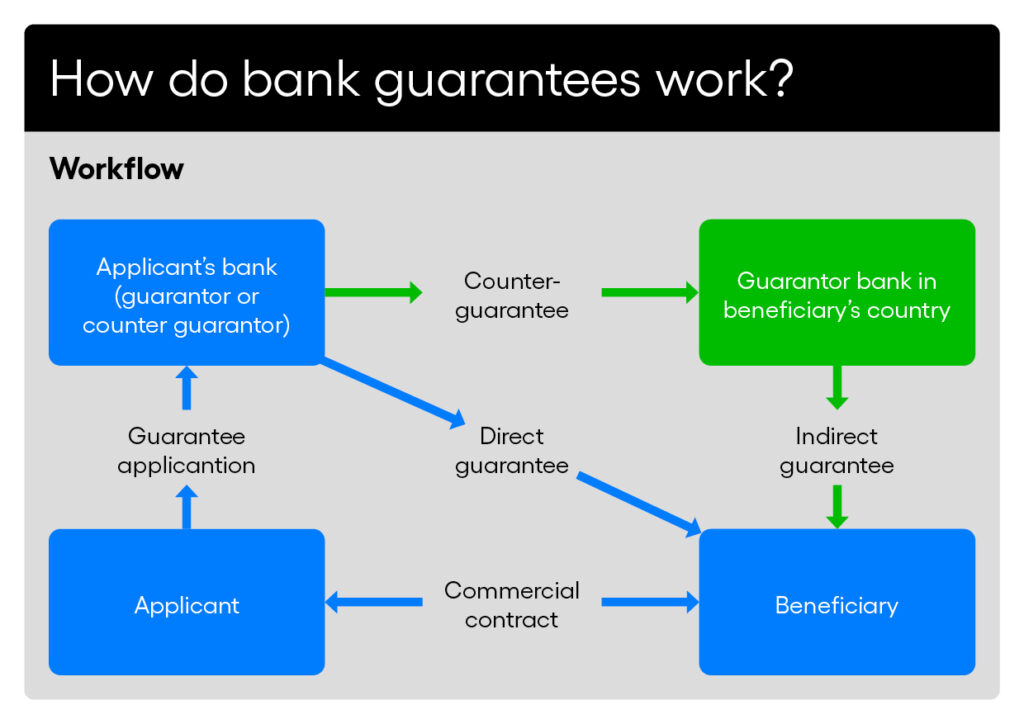

During contract negotiations, the project owner requests that the contractor to provide a Guarantee to secure the contractor’s performance. This Guarantee may cover the scheduled performance or completion of the project, secure an advance payment, or provide a warranty for the post-completion phase. The contractor then instructs its bank (the Issuing Bank) to issue the Guarantee in favour of the project owner for a specified amount and within the timeframe required for project completion.

In the event of a default by the contractor, the project owner can make a demand against the Guarantee. Upon the fulfilment of the documentary conditions specified in the Guarantee, the guarantor bank is obligated to pay the demand.

The indirect guarantee generally is cross border in nature.

What are the different types of bank guarantees and what are their functions?

| Type of Bank Guarantee | Definition |

|---|---|

| Bid/Tender Bond | Compensates the beneficiary if the applicant does not take up an awarded contract |

| Advance Payment Guarantee | Compensates the beneficiary if the applicant fails to refund the advance payment in the event of non-performance |

| Performance Bond | Compensates the beneficiary if the applicant fails to perform in accordance with the contract |

| Retention/Warranty Bond | Compensates the beneficiary if the applicant fails to complete the installation/perform under the warranty |

| Commercial Standby Letter of Credit (SBLC) | Assures the beneficiary of the applicant’s prompt payment for goods supplied |

| Financial Guarantee | Assures the beneficiary of repayment of indebtedness |

| Utility Bond | Given to beneficiary in lieu of cash deposit |

| Customs Bond | Allows an applicant (importer) to defer payment of customs duty for goods imported or temporarily import goods without duty payment |

What are the benefits to using bank guarantees?

- Helps corporates to secure a business contract: Clients can provide a bank undertaking to their customers as a form of security against potential defaults on the underlying contract.

- Facilitate the contracting/infrastructure business: Guarantees are inherent to the contracting business – starting with a bid / tender bond and typically followed by advance payment bond, performance bond and retention / warranty bond. Government authorities often require assurance that tax obligations will be met once the importing party sells the goods in the country.

- Payment assurance in place of cash in advance: Commercial standby letters of credit are commonly used in the open account trade, allowing buyers to provide payment assurance to their suppliers, reducing the need for cash in advance.

- Enable group companies expand their banking facilities: Financial Guarantees provide lenders with assurance of prompt repayment of indebtedness. These guarantees are often used by parent companies to assist their overseas subsidiaries in securing local borrowing in their countries of domicile.

Use case: A bank guarantee is used to secure a contract

Background

Build Construction Company specialises in the construction of infrastructure such as roads, dams, railways, and more. They are actively involved in overseas construction projects.

Requirements fulfilled by guarantees

As a construction company, they take part in overseas projects as a main contractor or sub-contractor.

- To secure a construction project, Build Construction Company typically needs to provide a bid bond issued by a local bank in the project location.

- Once awarded a contract, the company must provide a performance guarantee and, if an advance payment is received, an advance payment during the project.

- The guarantee helps free up the working capital for procuring equipment and materials needed for the completion of the project, which may even involve settlement under a LC.

- Many infrastructure projects are in higher risk countries and indirect guarantees can help assure beneficiaries of the company’s performance.

- A warranty bond facilitates the release of payments, eliminating the need for the project owner to set aside retention money.

Documentary collection

What are documentary collections? And what are the types of collections?

Documentary collections are a form of payment settlement, either on a sight basis or usance basis, where the buyer reviews the documents sent by the seller through the banking channel and either pays or accepts the documents to pay on the due date.

Collections can be either a sight basis or a usance basis. In the former, the seller exchanges documents for the delivery of goods against payment, with the documents being released to the buyer only upon payment. In the latter, the seller releases the goods prior to payment, based on the promise of payment as evidenced by the acceptance of a bill of exchange, or other agreed terms.

Parties involved in documentary collections

- Seller (Principal): The party who instructs the bank to handle documents.

- Remitting Bank: The bank instructed by the principal to send the documents.

- Collecting Bank: The bank tasked with presenting the documents to the buyer.

- Buyer: The party who accepts the documents.

Typical flow of a documentary collection process

The exporter entrusts the collection of payment to the remitting bank (the exporter’s bank) through the importer’s bank, known as the collecting or presenting bank.

The exporter provides instructions to the importer’s bank to release the documents – typically the commercial invoice, bills of exchange and transport documents – along with payment and document release instructions. The collecting bank is responsible for receiving payment from the importer, which is then remitted to the exporter through their bank in exchange for those documents.

Documentary collection usually involves a bill of exchange (draft) that serves as a legal demand for the importer either to pay immediately upon presentation (sight) or to accept the draft and pay on a specified future date.

The collection schedule determines the action expected of the importer’s bank. It is important to note that banks act as agents alone and do not assume any liability beyond following the collection instructions.

Commonly, documentary collection transactions adhere to the ICC URC 522 rules.

What are the risks?

Exporter’s risk: While the exporter controls the release of documents, if the importer fails to collect the documents when the goods are in transit or have reached the destination, the exporter may need to quickly find another buyer.

Importer’s risk: The importer may not pay even after accepting the draft, requiring the exporter to pursue legal action in court for payment.

Use case: A collection process is used to facilitate garment transactions between a buyer and supplier

Background

AXL Company, based in London, sources ready-made garments according to specific requirements and sells them to prominent retailers both domestically and internationally. They primarily import garments from Supplier BD in Bangladesh and hold a strong market position in Europe, recognized as a reputable buyer. A contract is established between AXL and Supplier BD, specifying payment through the collection process, either at sight or on a usance basis. This method lowers transaction costs, as the bank’s role is limited to managing document dispatch and collection, without any payment obligation.

Requirements fulfilled by the collection process by AXL’s working capital cycle

As a buyer, AXL benefits from the collection process to maintain efficient cash flow in their working capital cycle:

- Ensures prompt shipment and minimizes the risk of short shipments.

- Guarantees that goods meet specified quality standards, allowing AXL to inspect goods before payment.

- Provides clear documentation, enabling AXL to make timely payments and confirm these to suppliers.

- Facilitates financing to meet payment obligations to suppliers.