Managing cash tied up in procurement, supplier payment, and collections are key aspects of working capital management. In the context of supply chain finance (SCF):

- Working capital solutions help companies manage their cash conversion cycle and net working capital, using financing methods such as receivables discounting, factoring and payables finance.

- SCF also includes loans that bridge the cash gap between paying suppliers and getting paid by customers.

CFOs prioritise working capital management because it is important for their companies’ financial health and market competitiveness vis-à-vis their market peers. SCF solutions are financial tools that CFOs can avail to optimise their companies’ working capital components – inventory, trade receivables and trade payables.

Companies’ liquidity strategies include optimising the cash conversion cycle by managing working capital components. The cash conversion cycle affects funding needs and financing costs. With global supply chains, additional external factors such as geopolitical conflicts, transportation disruptions and regulatory shifts can be disruptive – preparedness through working capital management, including SCF solutions, can help companies weather such crises.

SCF solutions help CFOs conserve and unlock cash for more effective working capital management. Not only do they provide benefits in the day-to-day running of the business, but their effects also extend to shareholder value and enterprise valuation as free cash flow directly supports dividends, reinvestments and debt repayments.

Certified Trade Finance Professional (CTFP)

Defining the financial toolbox: Supply chain finance vs. trade finance products

How might a company manage its working capital?

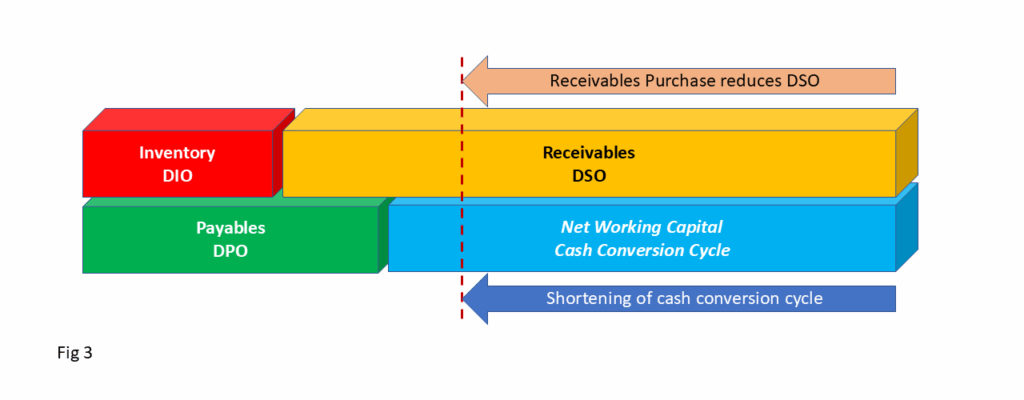

Working capital solutions are methods that enable companies to reduce their cash conversion cycle. This may involve shortening of collection days, lengthening payable days, or reducing inventory in stock, each aimed at minimising net working capital.

SCF solutions can help CFOs achieve these goals and reduce the need for borrowings on their balance sheet.

Read: ‘What is trade finance?‘

SCF solutions for working capital optimisation include the following techniques or concepts under Receivables Purchase:

- Receivables Discounting – sellers of goods and services sell individual or multiple receivables (represented by outstanding invoices) to a finance provider at a discount.

- Forfaiting – consists of the without recourse purchase of future payment obligations represented by financial instruments or payment obligations (normally in negotiable or transferable form), at a discount or at face value in return for a financing charge.

- Factoring – in which sellers of goods and services sell their receivables (represented by outstanding invoices) at a discount to a finance provider (commonly known as the ‘factor’).

- Payables Finance – provided through a buyer-led programme within which sellers in the buyer’s supply chain are able to access finance by means of Receivables Purchase.

There are also loan-based SCF techniques that provide financing of the net working capital or the cash conversion cycle – these are on-balance sheet borrowings for the company, and include:

- Loan or Advance against Receivables – financing made available to a party involved in a supply chain on the expectation of repayment from funds generated from current or future trade receivables and is usually made against the security of such receivables, but may be unsecured;

- Distributor Finance – provision of financing for a distributor of a large manufacturer to cover the holding of goods for re-sale and to bridge the liquidity gap until the receipt of funds from receivables following the sale of goods to a retailer or end-customer;

- Loan or Advance against Inventory – financing provided to a buyer or seller involved in a supply chain for the holding or warehousing of goods (either pre-sold, un-sold, or hedged) and over which the finance provider usually takes a security interest or assignment of rights and exercises a measure of control;

- Pre-Shipment Finance – is a loan provided by a finance provider to a seller of goods and/or services for the sourcing, manufacture or conversion of raw materials or semi-finished goods into finished goods and/or services, which are then delivered to a buyer.

These financing techniques are more elaborately defined in the GSCFF Standard Definitions for Techniques of Supply Chain Finance. As noted in the guide, financing arrangements may be known by different names according to different markets and financiers.

Deployment of SCF solutions is a strategic initiative requiring commitment from the companies’ C-suite, as implementation often involves teams beyond finance or treasury, engaging functions such as procurement, sales and operations. For example,

- A receivables purchase arrangement may require the sales and collections teams to facilitate changes in collection procedures;

- A payables finance programme may involve the procurement team engaging suppliers with the financing offer.

Key performance indicators (KPIs) that CFOs might monitor when evaluating working capital programs are

- collection days or Days Sales Outstanding (DSO),

- payable days or Days Payables Outstanding (DPO),

- Cash Conversion Cycle (CCC),

- cost of financing, and

- return on capital employed (ROCE)

These metrics offer visibility into how efficiently the company is managing its receivables, payables, and related liquidity needs. A well-executed SCF strategy should demonstrate improvements in these KPIs, aligned with the company’s liquidity and profitability goals.

From here on, this article focuses on SCF solutions that optimise working capital, specifically solutions that improve DPO and DSO.

Supply Chain Finance Course Bundle

How does supply chain finance improve working capital?

One of the key value propositions of SCF is the improvement of a company’s net working capital position, which can be achieved via improving DPO and DSO.

- A company’s DPO can be improved by successfully negotiating longer credit terms with suppliers. The buyer’s ability to offer a payables finance programme through its financier provides the supplier with needed liquidity, making it more likely to grant the requested credit terms.

- A company’s DSO can be improved by selling its trade receivables. In this arrangement, the financier purchases eligible receivables from the company on a without-recourse basis, underwriting the default and insolvency risk of the debtor (buyer).

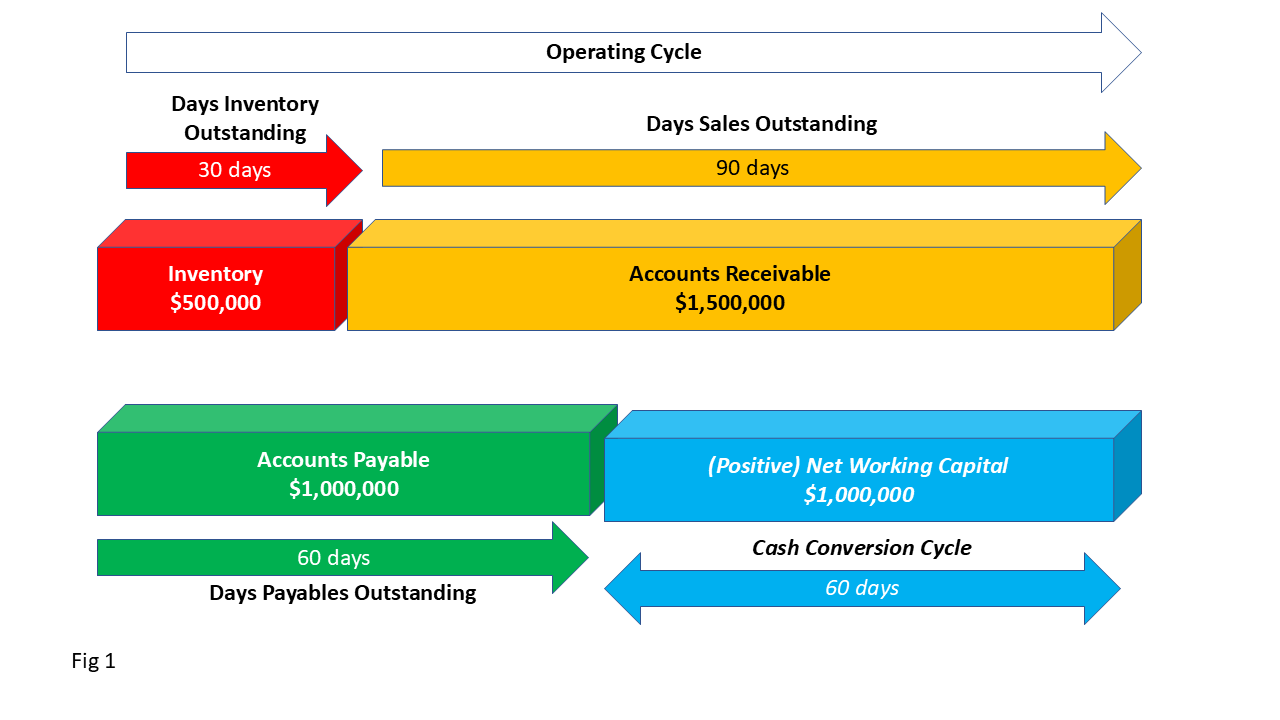

Example of a company that may need to borrow to finance its cash conversion cycle and net working capital:

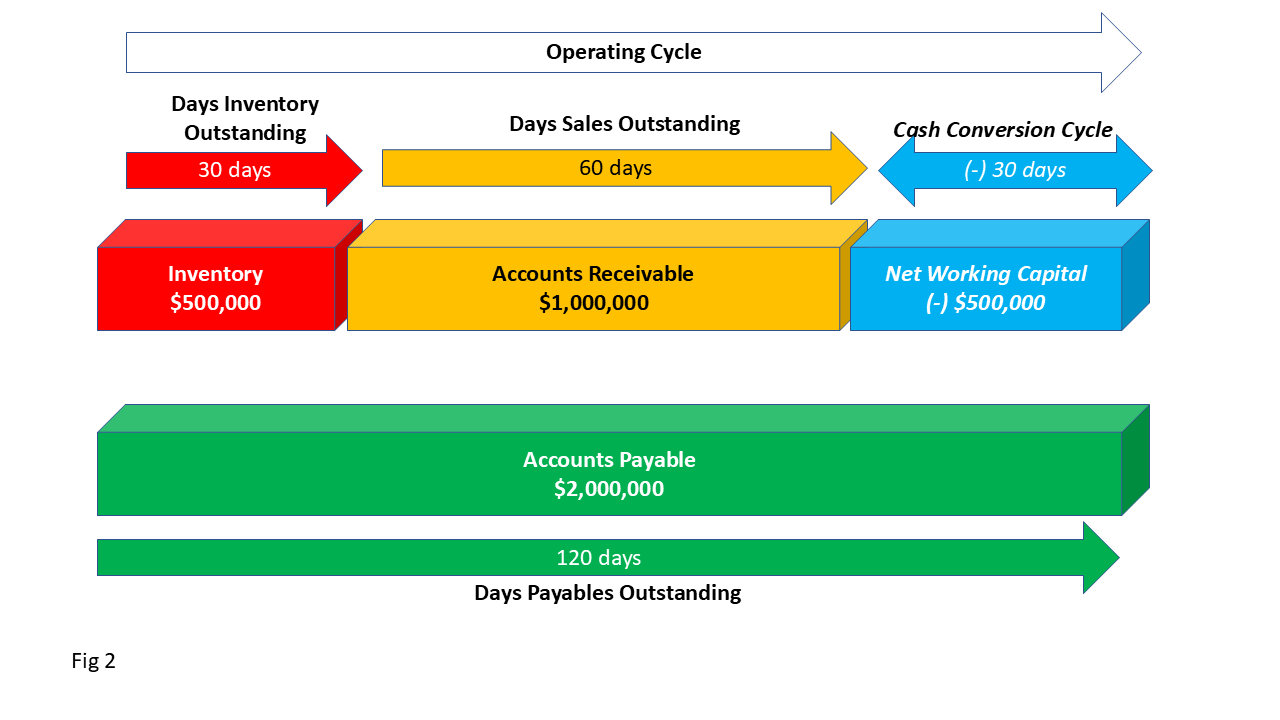

Example of a company that does not need to borrow because it has a negative cash conversion cycle and negative net working capital:

Effect of receivables purchase techniques on working capital:

The financing schemes for working capital optimisation must be appropriately structured and implemented. It is important that the extension or lengthening of DPO using SCF techniques such as Payables Finance benefits the suppliers and does not harm the buyer-supplier relationship.

A buyer must not be perceived as taking advantage of its suppliers through a Payables Finance program. While the buyer aims to optimise its cash conversion cycle by extended payment terms, it stands to gain by ensuring that the Payables Finance programme is a win-win arrangement for both parties.

Suppliers (especially SMEs) can benefit from a Payables Finance programme in multiple ways:

- Access to financing on a without-recourse basis, meaning that the supplier’s DSO decreases despite the extended credit terms;

- Lower cost of financing, especially when the buyer’s credit rating is stronger than that of the supplier;

- The supplier is able to grow its business with the buyer without having to secure independent financing.

In addition to the improvement in DPO, buyers may also benefit in the following ways:

- Mitigation of supplier non-performance risks due to liquidity or financing problems

- A more resilient supply chain, strengthening supplier loyalty by availing competitive financing to the suppliers

- Embedding ESG criteria into their SCF programs and integrating the suppliers’ sustainability data in the buyer’s Scope 3 emissions reporting.

CFOs and the bigger picture: Free cash flow (FCF) and Return on Capital Employed (ROCE)

Improving working capital has a direct impact on free cash flow (FCF) and return on capital employed (ROCE).

- FCF measures the cash a company generates from operations after deducting capital expenditures. Positive FCF strengthens a company’s ability to pay down debt, fund investments, and pay dividends. (A negative FCF may indicate that the company needs to raise capital.)

- ROCE measures how efficiently a company uses its capital to generate operating profits. A higher ROCE means the business is generating more profit per dollar of capital used.

SCF can help companies improve both metrics by optimising the cash conversion cycle:

- For buyers: Increasing DPO preserves cash, reduces the need to borrow, and lowers capital employed.

- For suppliers: Reducing DSO generates cash enabling it to pay down debt, reduces receivables and may cut financing costs lifting EBIT.

The combined effect is an improvement in liquidity, a reduction in financial leverage or gearing, and strengthening of capital efficiency.

See the table below for a simplified numeric example of how SCF helps improve FCF and ROCE for both the buyer and the supplier in a Payables Finance programme.

| Buyer | Supplier | ||

| Before SCF | After SCF (Payables increase $50m) | Before SCF | After SCF (Receivables drop $3m; EBIT +$0.1m from interest savings) |

| [A] EBIT: $50m [B] Taxes: $10 [C] Δ Working Capital: $0 [D] OCF: (A) – (B) + (C) = $40m [E] Capex: $20m [F] FCF: (D) – (E) = $20m FCF = Operating Cash Flow (OCF) – Capital Expenditure (Capex) | [A] EBIT: $50m (no Δ) [B] Taxes: $10m (no Δ) [C] Δ Working Capital: +$50m (due to higher payables) [D] OCF: (A) – (B) + (C) = $90m [E] Capex: $20m (no Δ) [F] FCF: (D) – (E) = $70m | [A] EBIT: $2m [B] Taxes: $0.4m [C] Δ Working Capital: $0 [D] OCF: (A) – (B) + (C) = $1.6m [E] Capex: $1m [F] FCF: (D) – (E) = $0.6m | [A] EBIT: $2.1m [B] Taxes: $0.42m (on higher EBIT) [C] Δ Working Capital: +$3m (due to drop in receivables) [D] OCF: (A) – (B) + (C) = $4.68m [E] Capex: $1m (no Δ) [F] FCF: (D) – (E) = $3.68m |

| [A] EBIT: $50m [B] Total Assets: $600m [C] Current Liabilities: $100m [D] CE: (B) – (C) = $500m [E] ROCE: (A) / (D) = 10.0% ROCE = Earnings before Interest and Taxes (EBIT) / Capital Employed (CE) | [A] EBIT: $50m (no Δ) [B] Total Assets: $600m (no Δ) [C] Current Liabilities: +$50m (increase in payables) = $150m [D] CE: (B) – (C) = $450m [E] ROCE: (A) / (D) = 11.1% | [A] EBIT: $2m [B] Total Assets: $20m [C] Current Liabilities: $5m [D] CE: (B) – (C) = $15m [E] ROCE = (A) / (D) = 13.3% | [A] EBIT = $2.1m (+$0.1m interest savings) [B] Total Assets: $17m (receivables reduced by $3m) [C] Current Liabilities: $5m (no Δ) [D] CE: (B) – (C) = $12m [E] ROCE: (A) / (D) = 17.5% |

The benefits for the supplier in the Payables Finance programme example can also be realised when a company enters into a Receivables Purchase arrangement to sell its receivables.

The uplift in FCF and ROCE from working capital optimisation using SCF techniques is often a step change, i.e. a one-off improvement, and further gains depend on improving operational performance. Auditors will assess SCF programs under the relevant accounting standards to determine if the intended accounting treatment is appropriate and compliant.

What CFOs are looking for in supply chain finance solutions

CFOs aim enhance working capital, reduce risks in the supply chain, reduce costly debt and improve ROCE. These goals serve as key considerations when evaluating SCF solutions.

Some of the key features CFOs assess in SCF programmes include:

- Accounting treatment: Does the structure of the programme support an improved cash conversion cycle (CCC) either through extended DPO or reduced DSO in a way that aligns with disclosure requirements under applicable accounting standards such IFRS or US GAAP?

- Impact on relationship with trade counterparties: Are the customers or suppliers agreeable/disagreeable to the SCF programme, e.g. does a customer object to assignment of its debt to the financier, and do suppliers find a Payables Finance proposition attractive and fair?

- User experience: Does the solution require technology integration and how ready is the company for such / Is the programme user-friendly for the company and its trade counterparts?

Some of the key adoption drivers of SCF solutions are:

- The company’s financial objectives: What are the financial metrics (e.g. DPO, DSO, CCC, FCF, ROCE) that the company aims to improve using appropriate SCF techniques?

- The company’s supply chain objectives: Does the company seek to strengthen supply chain resilience by offering financing to suppliers? Is there a cost benefit in the supply chain as a result of SCF adoption?

- Use of digital tools: The adoption of digital capabilities and data-driven processes enhance visibility, control, and efficiency in managing and financing the supply chain.

Financiers may offer their SCF solutions using digital tools, in approaches that include:

- Use of the financier’s proprietary platform

- Use of a multibank platform

- Partnerships with third-party platforms such as fintechs and procurement-to-payment platform providers

- Integration with the company’s platform

CFOs may have their preference for choice of platform approach, to be mutually agreed with the financier. Their choice of financier may depend on the institutions’ level of risk coverage, expertise in SCF and ability to customise solutions.

Supply Chain Finance Course Bundle

Aligning SCF strategy with business objectives

CFOs can integrate SCF into their broader capital strategy by leveraging financing techniques that unlock liquidity otherwise trapped in working capital. This can enhance cashflows, reduce reliance on bank borrowings and interest-bearing debt, and fund strategic initiatives, ultimately strengthening the company’s financial resilience and competitive position.

Embedding SCF into corporate strategy addresses supply chain issues that impact cash flow, liquidity and supply chain stability. Specific SCF techniques—whether receivables purchase or payables finance—can be applied to address those needs. For instance:

- A payables finance programme can improve supplier solvency while extending DPO for the buyer.

- Receivables discounting or factoring can unlock trapped cash and transfer counterparty risk to financiers.

To make SCF programmes effective, finance, procurement, operations and legal teams must understand the intended outcomes of SCF programmes and align internally for collaboration.

First steps for new adopters

Companies exploring SCF for the first time can begin with a benchmarking exercise to assess how they compare with peers or competitors on key working capital metrics – DPO, DSO, CCC, FCF. Based on this analysis, they can engage their financial institution partners to identify suitable SCF solutions to close gaps or position themselves as best-in-class within their industry.

Alignment with ESG, digital transformation and geopolitical risk management goals

SCF can be structured to support ESG goals, particularly when extended to suppliers who commit to meeting the buyer’s sustainability targets, such as those in Scope 3 emissions and ESG disclosures.

SCF also supports digital transformation goals, for example by using digital data from purchase orders, invoices and goods receipts for financing. SCF platforms can provide CFOs with dashboards that offer visibility into procurement and sales operations, as well as related financing opportunities.

Geopolitical instability and supply chain disruptions have further highlighted the importance of resilient supply networks. SCF offers CFOs a way to support key suppliers—especially SMEs in vulnerable markets—by offering them early access to cash at lower costs, contributing to long-term supply chain stability.

SCF techniques, when implemented strategically, can be powerful tools to help CFOs free up cash, increase supply chain resilience and drive business transformation.