What happens when invoices go wrong?

Our contributor, Parshant Mittal, discusses the risks arising from inaccurate or fraudulent invoices in supply chain finance (SCF), their financial and legal consequences, and how digital tools and best practices can help prevent such lapses.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of ICC Academy or ICC.

Supply chain finance (SCF) is a set of financial solutions that enable businesses—especially micro, small, and medium enterprises (MSMEs) – to access working capital faster by unlocking funds tied up in invoices and trade receivables. It improves suppliers’ payment certainty and cash flow. Buyers can use these supplier benefits to simply improve supplier relationships or to offset supplier costs associated with other supply chain initiatives such as negotiating longer supplier payment terms, ESG compliance, and such.

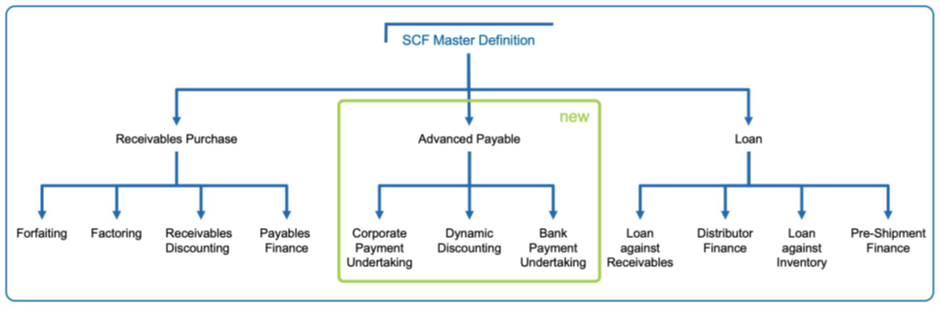

According to the Global Supply Chain Finance Forum (GSCFF), SCF operates under three main categories:

- Receivables Purchase

- Loans

- Advance Payables

SCF is especially vital for MSMEs, helping bridge the $2.5 trillion trade finance gap.

Most SCF transactions are based on open account terms, typically for 30–90 days, making the accuracy of trade documentation, especially invoices, essential for smooth execution.

Read: ‘SCF and working capital: What CFOs are really looking for‘

Types of SCF techniques

SCF typically follows two financing models:

- Supplier-led: Receivables Discounting (RD)

- The seller receives early payment by discounting their invoice with a financier.

- The rights to the invoice are transferred to the financer through a Receivables Purchase Agreement (RPA).

- Buyer-led: Payable Finance (PF)

- The seller is paid early, but the financing agreement is initiated by the buyer.

- An RPA is signed between the seller and financer, while the buyer maintains a separate agreement with the financer.

Both models may operate on recourse or non-recourse basis, determining whether the financer can recover the funds if the buyer defaults.

Certified Trade Finance Professional (CTFP)

What are the major risks in SCF?

Errors or falsifications in trade documents are among the most frequent risks in SCF. Typical issues include:

- Incorrect details such as buyer information, invoice amounts, payment terms, or quantities listed on invoices

- Mismatch between invoices and supporting documents like Bills of Exchange, Bills of Lading, Insurance certificates, Certificates of Origin, or Inspection Certificates

- Phantom invoices raised for non-existent transactions

- Duplicate invoices or documents submitted to multiple financiers

- Over- or under-invoicing to manipulate transaction values

- False shipment claims or misdescriptions of goods and services

What are the types of risks arising from document errors?

Errors in trade documentation can trigger a range of risks in SCF.

| Risk | Description |

|---|---|

| Document risk | Inaccuracies in invoices or supporting documentation leading to delays, disputes, or failed transactions. |

| Currency risk | Exposure to foreign exchange fluctuations during the transaction lifecycle. |

| Legal risk | Breaches of jurisdiction-specific regulations or contractual terms. |

| Performance risk | Failure of buyer or seller to meet contractual obligations. |

| Credit/non-payment risk | Buyer’s inability or refusal to pay after the transaction. |

Document-related risks tend to occur more frequently but are often unintentional, unlike performance or credit risks, which usually involve deliberate misconduct or breach of trust.

Supply Chain Finance Course Bundle

Understanding the real impact: Consequences of invoice errors and frauds

Inaccurate or falsified invoices can have serious consequences in SCF, including:

- Financial loss for financers, suppliers, or both

- Legal exposure through contract breaches and/or regulatory violations (including sanctions, anti-money laundering, and counter-terrorism financing requirements)

- Reputational damage that undermines trust across the supply chain

- Operational delays in shipment or delivery of goods and services

The risks multiply in Deep Tier Supply Chain Finance (DTSCF), where funding is layered across multiple tiers. A single erroneous Tier 1 invoice can trigger a cascading effect, impacting financers and stakeholders at Tier 2, Tier 3, and beyond.

Digital transformation and risk prevention

Digitisation and fintech innovation are transforming SCF by reducing manual errors and minimising fraud. These modern tools and platforms enhance accuracy, transparency, and resilience across the financing process.

How technology reduces these risks

Advanced solutions now enable real-time validation and monitoring of invoice data:

- Optical Character Recognition (OCR): Digitizes and extracts data from trade documents for automated verification.

- Artificial Intelligence (AI): Detects anomalies and suspicious patterns that may indicate fraud.

- API Integrations: Automates data exchange between systems, reducing mismatches and delays.

Key platforms and initiatives

Several global initiatives and platforms are setting new benchmarks for digital SCF.

- ICC Digital Standards Initiative (DSI): Standardises Key Trade Documents and Data Elements (KTDDE) across 36 documents to improve accuracy, harmonisation, and interoperability.

- Other industry-driven digital platforms and frameworks: Facilitate receivables financing, early payment programmes, and dynamic discounting, helping to streamline processes and expand access to working capital.

- Emerging innovations in SCF technology: Blockchain and distributed ledger systems are enabling greater transparency and auditability in trade finance. API-based ecosystems are improving interoperability between banks, fintechs, and corporates.

Together, these innovations empower fintechs, buyers, and suppliers to validate invoice data, streamline financing, and make SCF more scalable, secure, and efficient.

Risk mitigation strategies in SCF

To minimise fraud and reduce exposure, financers and platforms adopt multiple controls, including:

| Control | Description |

|---|---|

| Trade credit insurance | Provides external protection against invoice defaults |

| Enhanced due diligence (EDD) | Goes beyond standard KYC/CDD checks to validate the legitimacy of transactions. |

| Cash margin requirements | Maintains additional reserves from buyers or sellers as a safeguard. |

| Automated invoice generation | Ensures accuracy after contract or Purchase Order (PO) finalisation |

| Double verification | Independent cross-checks across departments to prevent data inconsistencies |

| Unified platform onboarding | Engages all stakeholders on a single system from invoice creation to payment |

Certified Trade Finance Professional (CTFP)

Case studies: Lessons from real-world scenarios

Several high-profile frauds illustrate the dangers of weak document control:

- Greensill Capital (UK): Failed to conduct adequate due diligence on clients and transactions, leading to high exposure and eventual collapse.

- Moneual Case (South Korea): Presented forged trade documents to get export receivables discounted from multiple banks.

- Right Step Staffing (USA): Falsified accounts receivable and services to obtain factoring finance fraudulently.

- Falcon Scam (India): Encouraged investors to finance fake SME invoices against higher returns, eventually halting payouts and collapsing the scheme.

These real-world examples underscore the importance of controls, due diligence, and verification mechanisms in SCF.

Reviewing final checkpoints before financing

| Best practice | Purpose |

|---|---|

| Double/Dual verification | Prevents errors and fraud through multiple internal checks |

| Automation post-PO | Reduces human error by generating invoices automatically |

| Financial monitoring | Tracks seller’s financial health to identify inconsistencies |

| Relationship due diligence | Confirms genuine links among buyers, sellers, and financers |

| Unified platform integration | Provides transparency and traceability across the SCF financing lifecycle |

SCF offers significant opportunities, especially for MSMEs, but it is not immune to risks. With multiple stakeholders involved, the potential for documentation lapses and fraudulent activity increases.

The cornerstones of safe SCF are accurate invoice generation, adoption of digital validation tools for document validation, and strong internal and external controls. Ultimately, every participant, from suppliers and buyers to financers and regulators, must collaborate and remain vigilant and proactive to ensure the integrity of these crucial financial flows.

References:

- http://supplychainfinanceforum.org/ICC-Standard-Definitions-for-Techniques-of-Supply-Chain-Finance-Global-SCF-Forum-2016.pdf

- https://www.adb.org/sites/default/files/publication/828506/adb-brief-219-deep-tier-supply-chain-finance.pdf

- https://bcrpub.com/product/world-supply-chain-finance-report-2025/

- https://www.dsi.iccwbo.org/_files/ugd/8e49a6_9f8444133fc64fc9b59fc2eaaca2888e.pdf