Bespoke training programmes

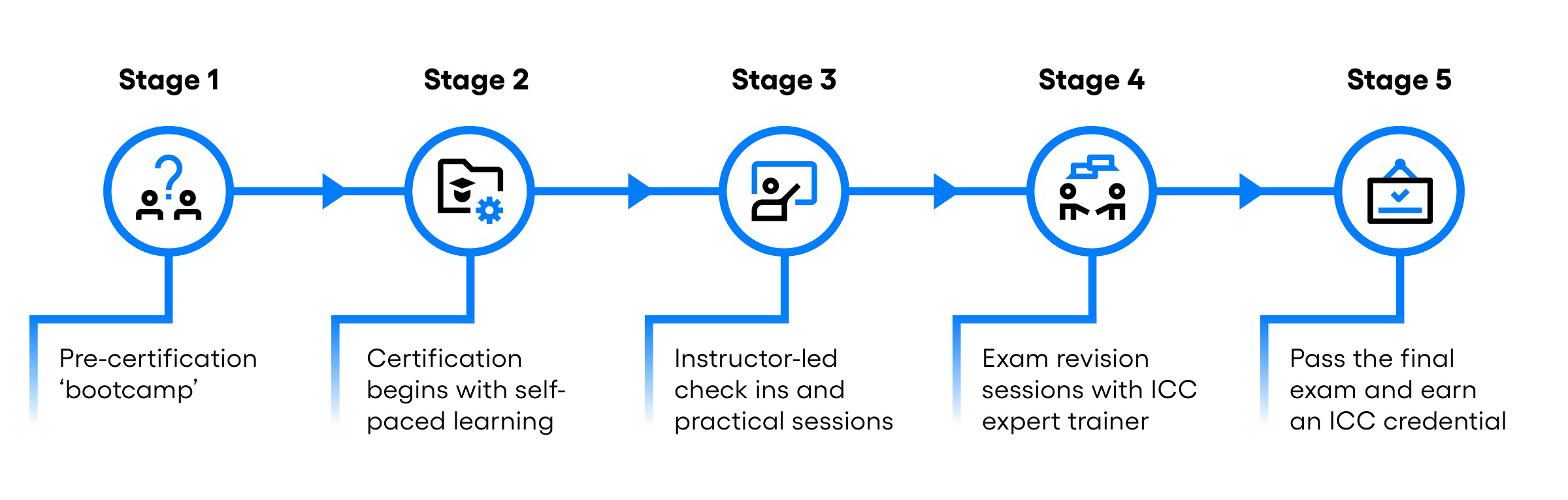

How it works

Topics we can train on

Bring your team up to ICC global standards

More than 1000 organisations in over 130 countries have enrolled their teams in ICC Academy certifications including large international banks, major shipping and logistics providers, multilateral development banks, mining groups, large manufacturers, government agencies and SMEs. Contact us now to discuss your needs and get a custom quote.

Case studies

What our clients say

Getting training directly from the 'horse's mouth' is more valuable to me - and other people looking to work with me - than having my knowledge certified by a third party who has not created the Incoterms® rules.

"I enrolled in the CTFP because this certification is authored by leading trade finance experts from the ICC’s Banking Commission, making it one of the most credible programmes available in the market. Each course is structured to ensure the essentials of global trade finance have been sufficiently covered."

"I see the CTFP as a perfect way for any trade finance person to (a) be part of a global community and (b) have a certification that highlights your expertise and automatically puts you at a certain level that is respected in the industry."

The course gives you a little advantage with customers to have this level of knowledge and training. I can advise clients correctly and the ICC certificate shows I am up to date.

Anyone in international logistics should master the Incoterms® rules and this certificate is a must. I got congratulated by the Head of Customs and Transport.